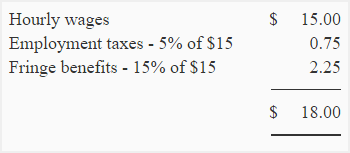

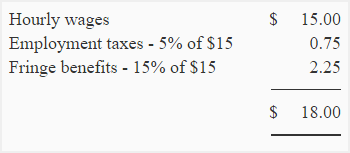

Compute the Standard Direct Labor Rate Per Hour

73-561 authorized deduction for board in the amount of eighty-five cents for a full meal and forty-five cents for a full meal rather than for reasonable value of board based on the actual cost of. For example if a forestry worker subject to a 900 per hour SCA prevailing wage rate is paid 1000 per hour 100 above the legally-required SCA prevailing wage rate of 900 and works 50 hours in a particular workweek the most that may be deducted from this workers wages for that week pursuant to a prior agreement covering specific deductions eg.

Direct Labor Standard Cost And Variances Accountingcoach

ROE usually increases since the repurchase of shares reduces the denominator avg.

. Every employee has the right to. No the FLSA does not require hazard pay. Dawson Toys Ltd produces a toy called the Maze.

Any person acting on behalf of an employer including a client employer or labor contractor who violates any provision of State wage and hour laws or State employer tax laws or any provision of section 10 of PL1999 c90 C2C40A-2 regarding compliance with State wage and hour laws or State employer tax laws including any provision of those laws concerning the misclassification. A standard cost _____ indicates the amount of direct labor direct materials and overhead for one unit of product. Study with Quizlet and memorize flashcards containing terms like What are the advantages of cloud computing over on-premises.

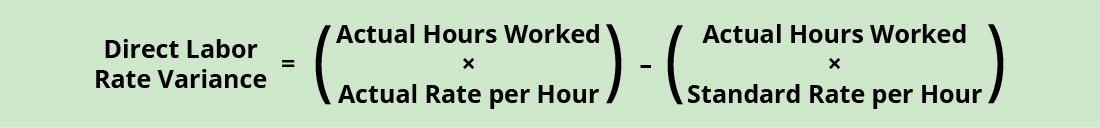

Every employee has the. B from 040 per hour to 047 until July 1 1968 and 050 thereafter for persons employed in hotel and restaurant industry. The direct labor rate variance could be referred to as the direct labor price variance The journal entry for the direct labor used in the.

When you are finished in FISS press F4 to. Compute its return on equity for 2018. She is therefore due the difference between the 8 of straight time already paid for these hours and the time and one-half overtime rate of 12 per hour for these hours or an additional 4 per hour for 10 hours or an additional 40.

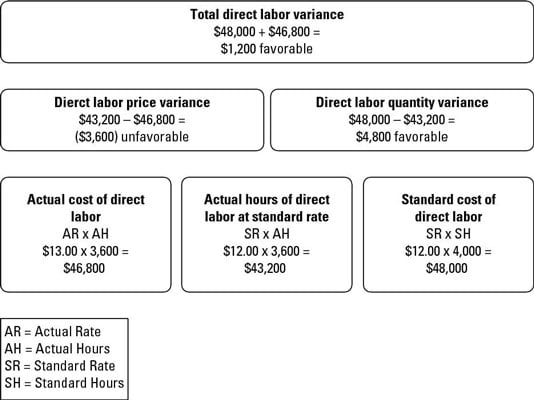

In some cases hazard pay may be. Note that DenimWorks paid 9 per hour for labor when the standard rate is 10 per hour. Actual allocation base times times the standard variable rate.

Twice the basic hourly rate for all hours worked on public holidays. 150 times the basic hourly rate for all hours worked on the weekly day off. Overtime is only limited to 2 hours a day 6 hours per week and 180 hours a year and should not exceed 90 days in a year.

Providers can continue to submit individual provider queries using the Fiscal Intermediary Standard System FISS Direct Data Entry DDE BeneficiaryCWF Option 10. Breaks meetings team-building activities sick days vacation time and mandatory training all eat away at total productivityThe portion of an employees hours that she can actually attribute to. This 1 difference is multiplied by the 50 actual hours resulting in a 50 favorable direct labor rate variance.

Card A manufacturing company accumulates the following data on variable overhead. A list of assets liabilities and equity can be found on what. If the labor rate is 25 per hour what is the per-unit cost of each product.

8 microns per toy at 035 per micron Direct labor. Colonels uses a traditional cost system and estimates next years overhead will be 480000 with the estimated cost driver of 240000 direct labor hours. Thus total wages due hypothetical employee B are 400.

11 hours per toy Q. Select the best answer Avoid large capital purchases On-demand capacity Go global Increase speed and agility All of the above What is the pricing model that allows AWS customers to pay for resources on an as-needed basis. If Starbucks had not repurchased common stock in 2018 what would ROE have been.

FLSA generally requires only payment of at least the federal minimum wage currently 725 per hour for each hour worked and overtime compensation for each hour more than 40 worked in a workweek in the amount of at least one and a half times the employees regular rate of pay. 1971 act increased gratuities limit to 060 per hour. Given that Direct material.

The company has recently created a standard cost. It manufactures three products and estimates these costs. Refer to the Inquiry Menu in this User Manual for additional information.

125 times the basic hourly rate for excess hours worked on regular working days. Follow the steps below when you are finished with FISS. Overtime is only limited to 2 hours a day 6 hours per week and 180 hours a year and should not exceed 90 days in a year.

She has been paid nothing for hours 51-55 and is due 12 per hour for each of these. When calculating man-hours for a project that spans multiple months managers need to appreciate that employees never spend 100 percent of their time at work on a project. Which of the following isnt on the balance.

125 times the basic hourly rate for excess hours worked on regular working days 150 times the basic hourly rate for all hours worked on the weekly day off Twice the basic hourly rate for all hours worked on public holidays. Mini PC Stick Fanless Windows-11-Pro Celeron J4125 8GB256GB MeLE PCG02 Small Computer Portable Micro PC Support HDMI 4K 60Hz 24G5G Wi-Fi Gigabit Ethernet BT42 Win10USB 30PXEPlexMicro SD Card.

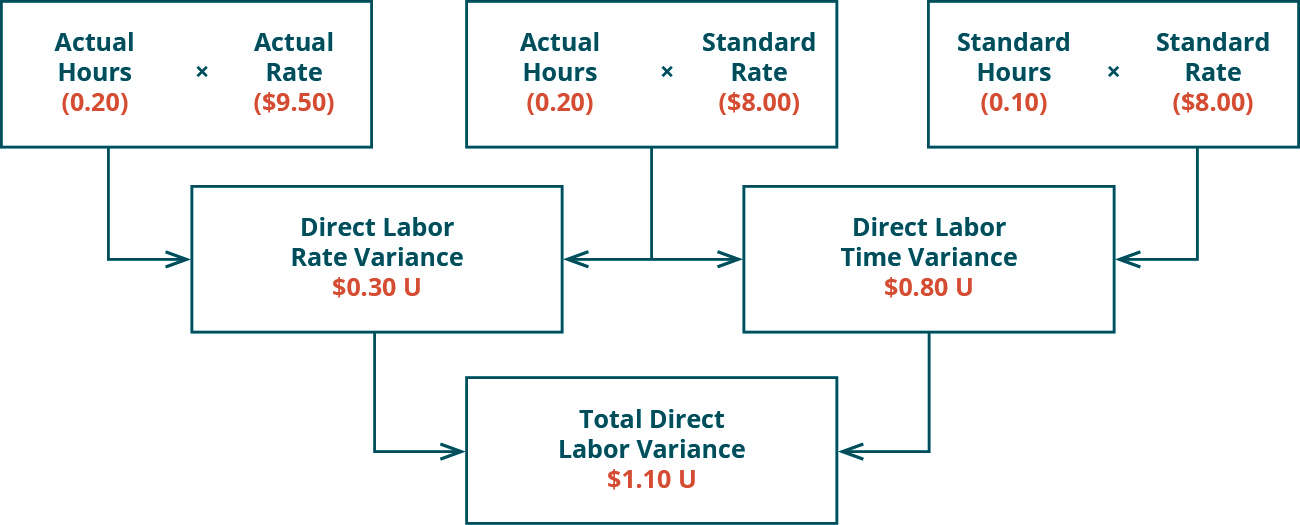

10 7 Direct Labor Variances Financial And Managerial Accounting

10 7 Direct Labor Variances Financial And Managerial Accounting

Direct Labor Rate And Quantity Standards Explanation And Examples Accounting For Management

How To Calculate Direct Labor Variances Dummies

Comments

Post a Comment